How to Prototype an Internet Startup

Prototyping an internet startup using the generic business model prototype

Oliver Grasl

7.4.2013

An illustration of how to prototype an internet startup using the generic business model prototype

Learn How to Prototype an Internet Startup Using The Generic Business Model Prototype

This is the fifth post of a series of posts in which I discuss how to use the business model prototyping approach to build a generic business model prototype. You can read the first post of the series Business Prototyping And The Generic Business Model Prototype. A list of all posts in the series can be accessed Prototyping Business Models And Market Strategies. In this post, we are bringing the generic business model prototype online for the first time and applying it to an internet startup.

The last post prepared the ground and discussed the ideas behind the prototype. Today we are bringing the first, rudimentary version of the generic business model prototype online – the prototype is a self-contained business simulation built using System Dynamics and the Stella® modeling environment.

You can access the model online – even though this post contains a lot of screenshots to explain our experiments, it will be more fun if you access the prototype and perform the experiments yourself.

We have created an online simulation.

Before I get into the details, let me recall the main objectives of the generic business model prototype:

- The prototype should be as SIMPLE as possible, yet still COMPLETE. We want to create the simplest possible prototype of a „generic“ business – the prototype should be easy to understand and not make any assumptions about a specific business, yet still, cover all aspects of a company’s value creation logic.

- The prototype should cover both BUSINESS MODELS and PROTOTYPING. The prototype should help us learn more about business models and also how to prototype different aspects of a business model, using the System Dynamics modeling and simulation approach.

- The prototype should be used as a BUSINESS EXPERIMENTATION LABORATORY. The prototype should allow as to experiment with different business scenarios. The idea here is to use the business prototype as a framework that can quickly be adapted to specific situations – experience shows that it is rarely necessary to model every aspect of a business in detail to answer a given question. So you can use the framework as a basis and elaborate those aspects of the model that are relevant to the problem at hand and thus rapidly create a business simulation.

The generic business prototype is simple, but this does not mean it is not powerful – on the contrary: next to covering all aspects of value creation (as discussed in my post on the A Generic Business Model Blueprint), the prototype also contains all the stocks and flows needed to provide a company’s balance sheet and cash flow statement. So we will be able to assess the financial health of the company we are simulating in real-time during the simulation.

Needless to say, even though the generic business model prototype is simple, it is still far too extensive to discuss all of its aspects in one blog post. Therefore my plan is to introduce the prototype over a series of posts.

To make the discussion more exciting I will apply the prototype to a simple business case, that of an internet startup. In today’s post, I will first introduce the internet startup and then experiment with some basic scenarios.

In my next post in this series, I will then investigate the overall model structure; each further post in Prototyping Business Models And Market Strategies will then cover one particular aspect of this structure in detail and introduce further scenarios.

An Experimentation Laboratory For Internet Startups

To make our experiments meaningful and allow us to calibrate the simulation model, we need to have a specific situation in mind: so let us imagine we are the founders of an internet startup that is providing an online service to registered customers. We have a small development team and the service we are providing is already online. We even have some initial customers. Today we want to experiment with some simple questions:

- How much money should we be spending on marketing?

- How much capital should the company have initially?

- Will we need debt financing?

Our generic prototype will provide the experimentation laboratory for this internet startup. But before we start our experiments to answer the questions above, we should take a closer look at our internet startup and discuss some of the underlying assumptions:

- Our company is an internet startup started by two founders who act as managing directors.

- Next to the founders, there is a small development team consisting of one product designer, a product developer and a product tester. We also have two customer service agents who deal with support requests.

- Our development team is capable of delivering twenty-five new features per year. For now, we are happy with this target output, so we do not expect the development team to grow.

- The number of customer service agents we need depends on the number of customers – the assumption is that every client posts one service request per month and that it takes ca. 10min to deal with a service request. So if we win new customers, the number of service requests will rise and thus the customer service team must grow. When the team grows, we will also need to add team management capacity. Our assumption here is that we need one team leader per thirty customer service agents.

- The number of product designers grows with the number of customers – the assumption is that 1% of all service requests are actually ideas for new features. It takes a product designer 10min to qualify a feature idea. When the team grows, we will also need to add team management capacity. Our assumption here is that we need one team leader per fifteen product designers.

- Our revenue comes from a monthly subscription fee of €20 that each customer pays. We assume the average collection time is two months, i.e. it takes two months until the revenue is collected and the cash arrives in our bank account.

- Our main costs are the wages for the team (€ 3000 each per month) and the two founders (EUR 6000 each per month) and also for the infrastructure equipment we need to deliver the service. We also assume that we will spend EUR 20,000 per month on marketing.

- We assume we will reach 100 customers per euro spent and that 0.01 percent of those will buy our product. So we need to spend around EUR 100 per customer. To keep the discussion simple initially we assume that we do not lose customers once we have won them.

- Next to our initial shareholder’s stock of EUR 700,000, we assume that we have access to debt financing to keep the operation going. New debts will be added as needed according to our cash coverage policy, to ensure that we have enough cash to cover our payments. Initially, the cash coverage policy is set to three months. Debt is repaid monthly over a period of five years at an interest rate of 5% per annum.

- Our simulation will cover a time span of five years, all calculations will be performed on a monthly basis, the monetary unit in the model is k€ (€1,000). One month is assumed to have 20 workdays.

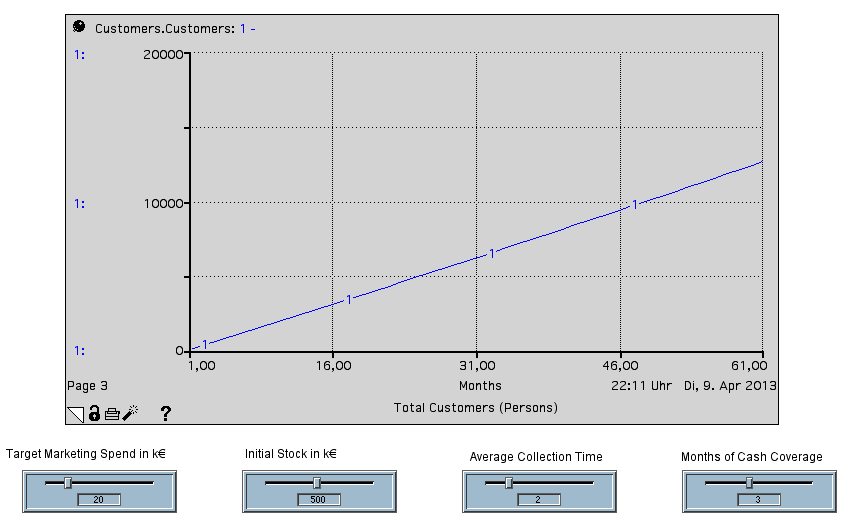

Let us run the simulation with these settings and perform some sanity checks to ensure that our model is behaving correctly: The number of customers increases (almost) linearly, we start with 100 customers and end up with almost 13,000. Given our assumption that we have spent € 1.2 Mio=5*12*20,000 on marketing over five years and that one customer costs € 100, this figure seems to be ok.

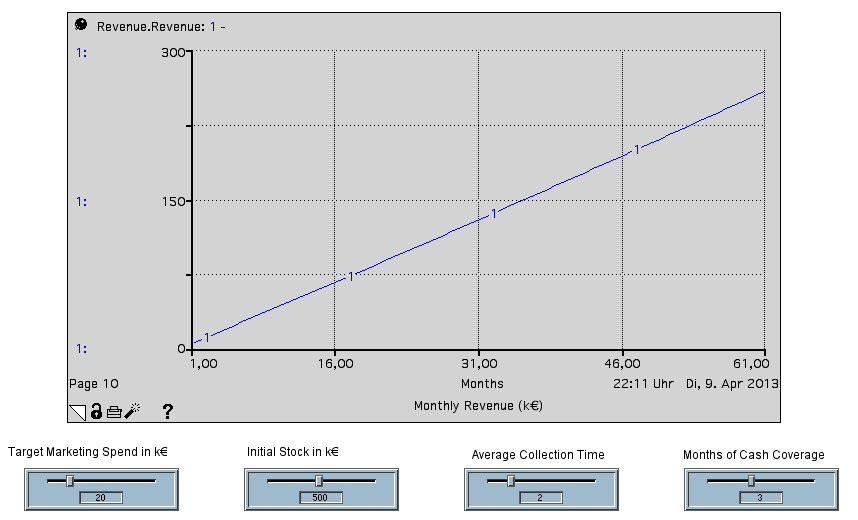

The monthly revenue increases in a proportional fashion to € 260,000 per month, which is also what we expect.

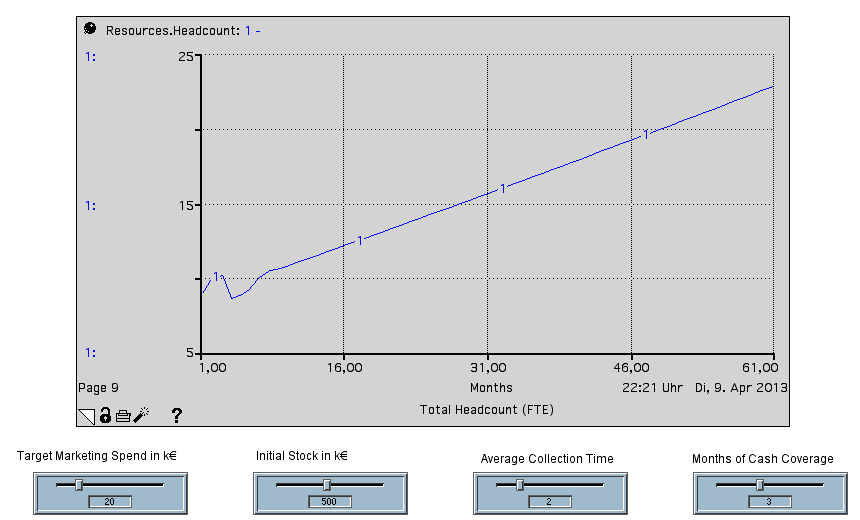

The next cross-check we should make is the total headcount. This goes up to around 30 persons: this sounds reasonable because if we have 12,000 customers with one service request per month taking 10min each, we need a service capacity of 12,000 customers* 1 request *10min duration/60min per hour/8h per day=250 workdays≈13 customer service agent FTEs. A similar calculation shows that we need ca. three product designers. Together with the three product developers, the product tester and the 2 managing directors and 1 team leader, this means we need 23 FTEs, which matches the figure the simulation gives us exactly.

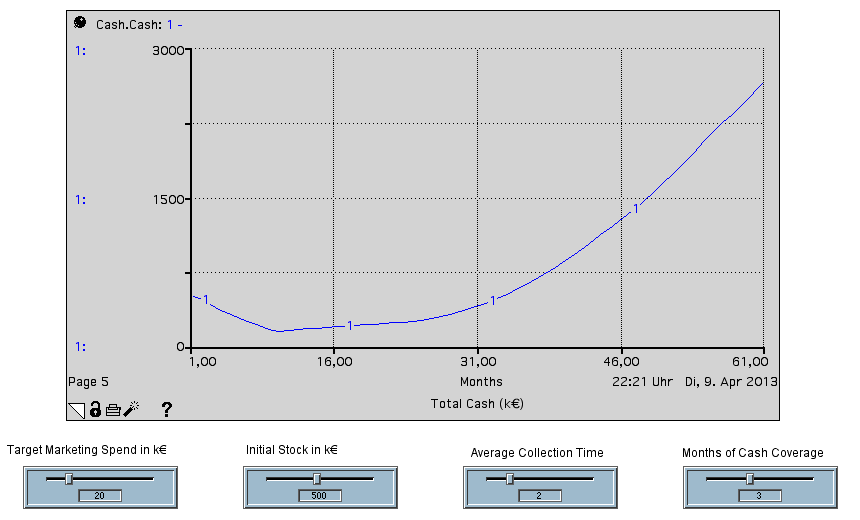

Now let us look at the companies financial situation. The first place to look here is the company’s stock of cash: this starts at € 500,000, which is equal to the initial shareholder’s stock. The level of cash immediately starts dropping (so we clearly are not profitable initially), reaching its lowest point after ca. 10 months, then it starts rising again. At this point we do not know where the net inflow of cash is coming from – debts or revenue?

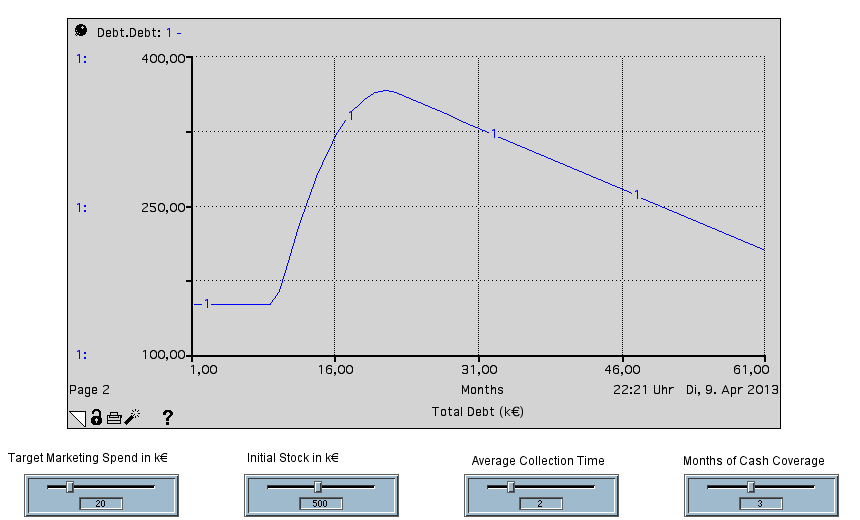

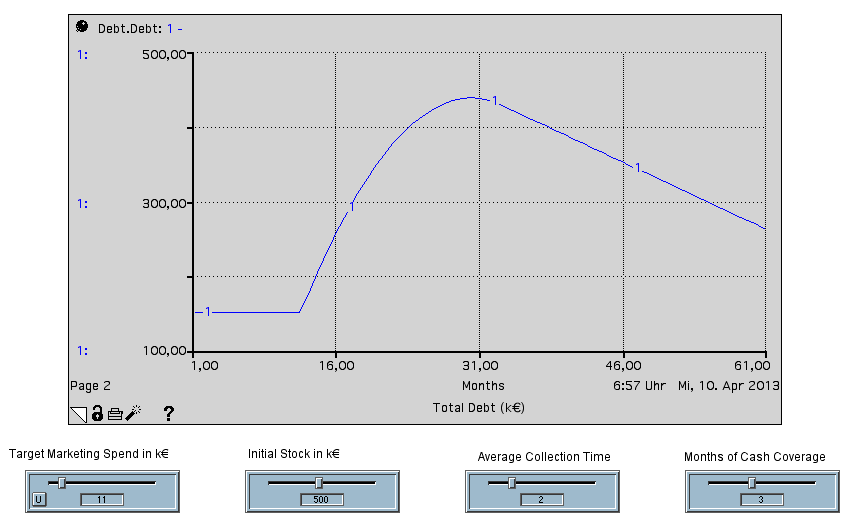

Let us check the debt situation next: we see that the company takes on massive debt after ca. 10 months, corresponding to the turning point in the cash level. It continues to take on new debt every month for another year before the debt starts decreasing again.

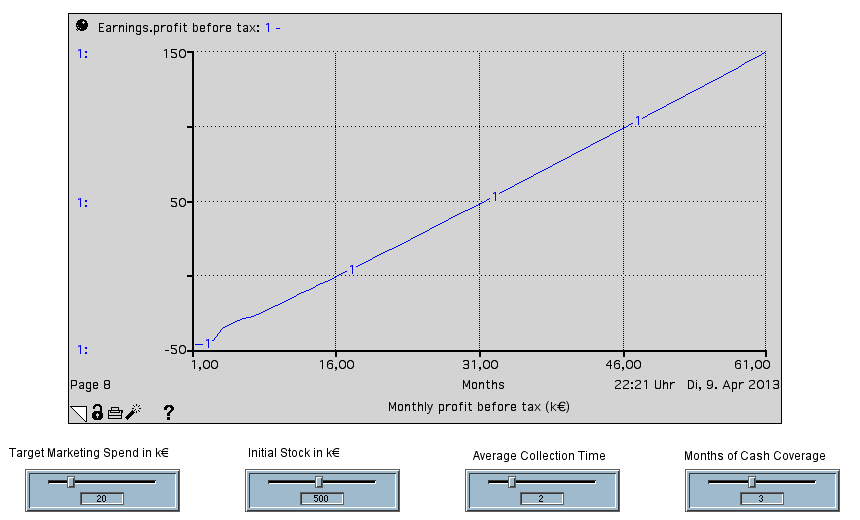

Now let us take a look at profitability: we reach monthly profitability after ca. 17 months. Of course, it would be fantastic news if our startup could achieve this – but there are still a number of aspects we need to consider before we can achieve this, e.g. growing the development team, training new employees, etc. I will cover these aspects in one of my next posts.

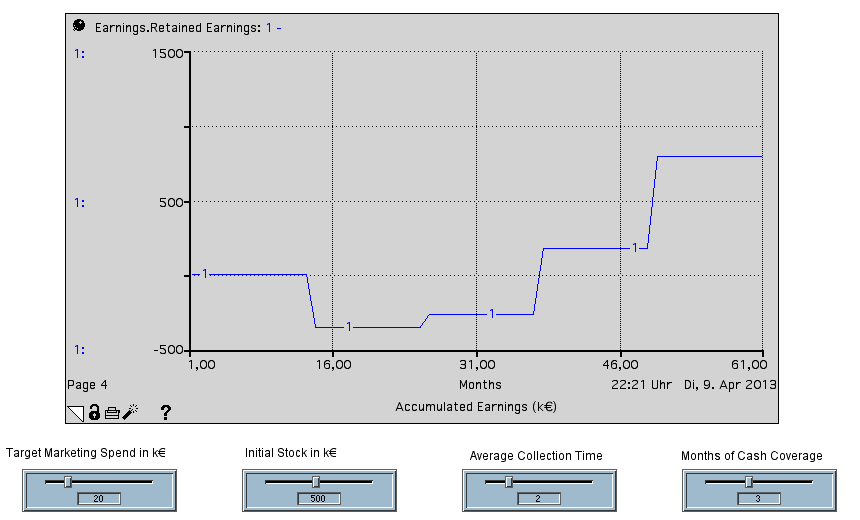

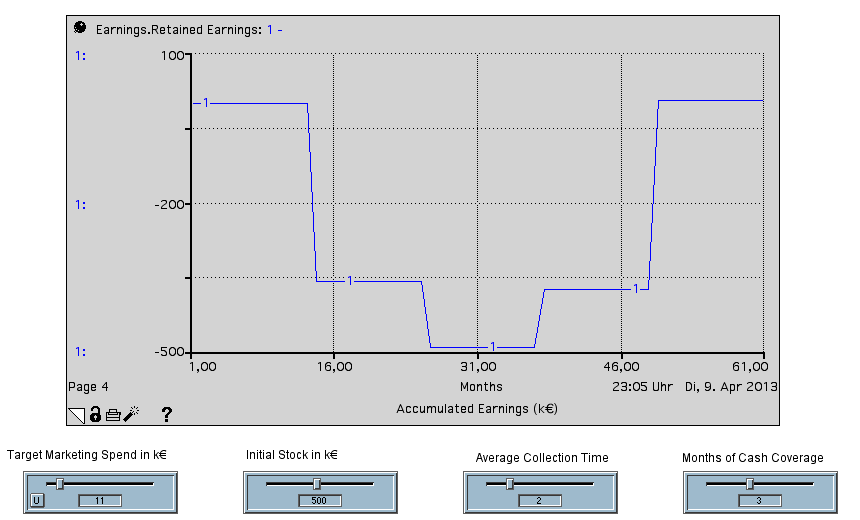

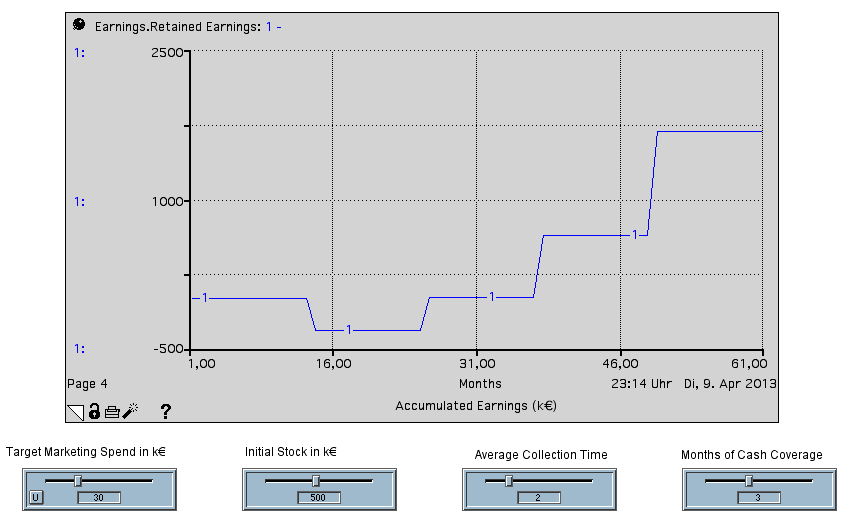

A check on the retained earnings shows that we reach break-even after three years, which sounds very reasonable for the base case (note the retained earnings are updated on a yearly basis, which is why the graph has discontinuities at the end of every year. We are also assuming all profit is retained in the company with no dividends being paid to the shareholders).

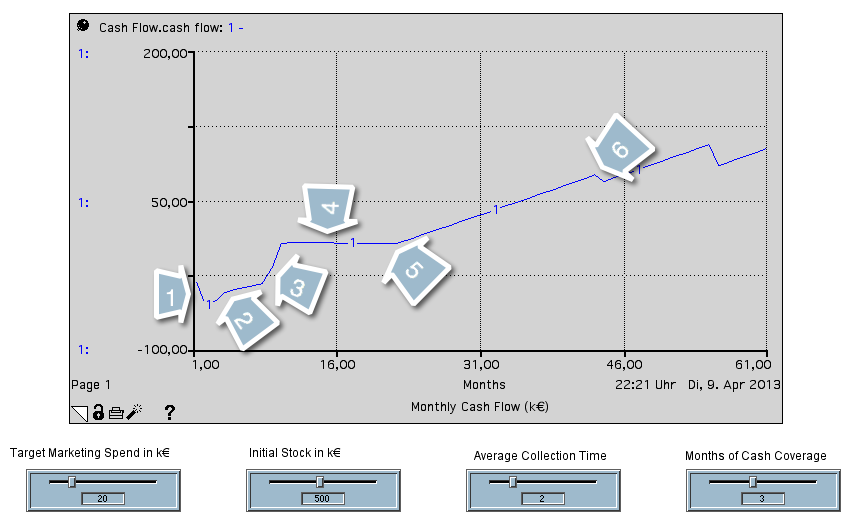

The most interesting graph to look at right now is the cash flow: primarily because it is the main KPI you should observe in financial management, but also because the behavior of the cash flow changes strongly over time in this simulation.

Let us examine this graph more closely to make sure we understand this behavior:

- For the first three months, the cash flow drops fairly strongly. This is because the company incurs expenses (such as marketing expenses) in the first month of operation but does not actually meet its obligations (i.e. pay its bills) until the second month.

- After two months, the cash flow starts improving – this is because we are gaining customers and revenue, without changing our monthly cost.

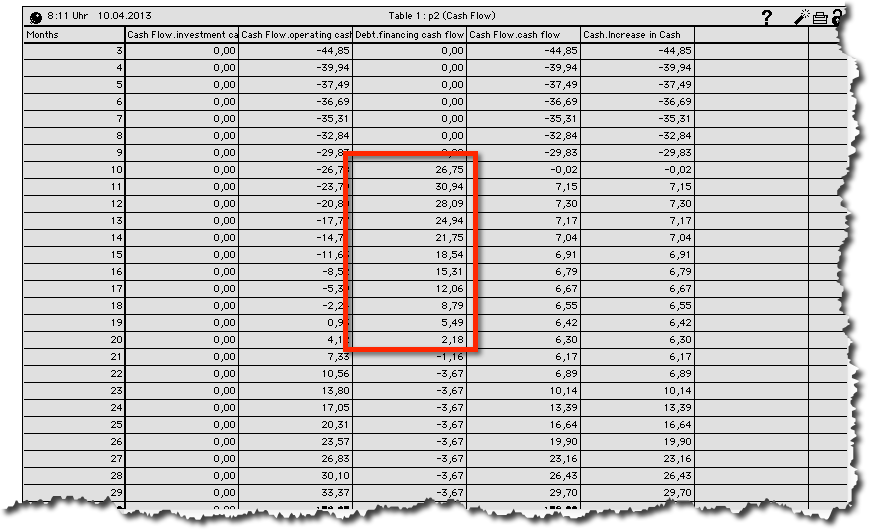

- After about nine months, our stock of cash is depleted and our cash coverage policy (which is set to two months) kicks in: we start taking up debts in month 10, peaking in month 11, and do not stop taking on new debt until month 21 – you can see this best if you look at the debt cash flow in the financial statements (see screenshot below)

- Our cash coverage policy then ensures that the cash flow is almost constant because it ensures the gap in operating cash flow is filled with new debts.

- At last, at month 19 our operating cash flow becomes positive and at month 21 we have accumulated enough cash to stop taking on new debts – the cash flow starts to increase.

- At month 44 our cash flow suddenly drops – this is because our company has to pay tax for the first time.

You may like to take some time to play with the cash coverage policy – if you increase the policy to, say, 6 months, then the basic shape of the cash flow curve remains the same. But we need to take on debt much sooner and it takes longer before cash flow starts rising again. Try and see what happens when you reduce the cash coverage policy to just one month!

Another important influence on our cash flow and our debt financing is the average time it takes to collect revenue: our assumption is that 2 months on average. If you increase this time to 6 months, then the amount of debt you need to finance your company more than doubles!

Note: Despite calibrating the model to a specific situation we need to ensure that we do not compromise the generality of the model. We will do this by ensuring that we model each aspect in the most generic way – this should not be too difficult because we are modeling a startup with a simple structure and a single product. Once we have covered all aspects of the prototype we can then calibrate the model to a different kind of business to test whether it is really generic. If yes, all is well. If not, this will be an opportunity to learn something new and improve the model.

We have checked our model and verified that the results match our assumptions using some simple “back of the napkin” calculations. Now it is time to start experimenting with our internet startup.

Some Concrete Experiments

How Much Money Should we Spend on Marketing?

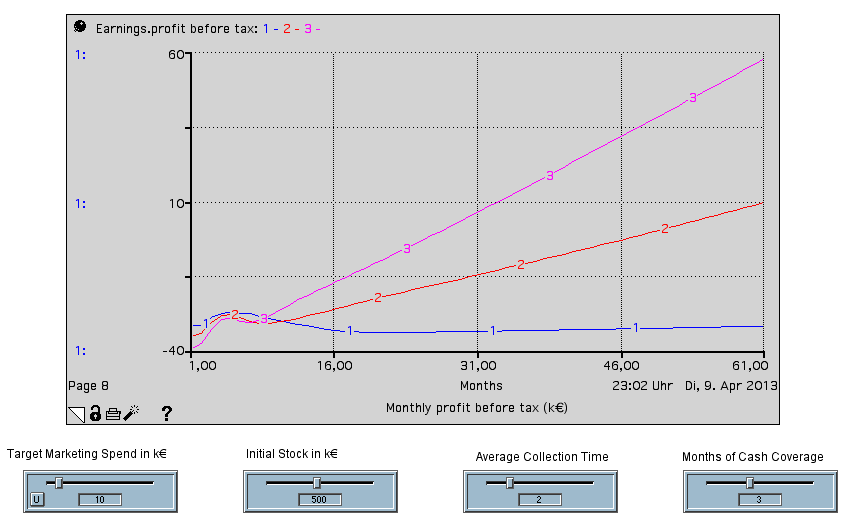

The first is we should investigate is marketing, after all, this is what is going to bring in the customers. Assuming we want to reach profitability within 5 years, how much money do we really need to spend on marketing?

The KPI to look at here is the monthly profit before tax. The model contains a graph especially for this – a little experimentation with the target marketing spends setting quickly shows that you need to spend at least € 5,000 per month to reach profitability. The diagram below shows three test runs, with settings for €1,000, €5,000 and €10,000 respectively.

But is it enough to just reach profitability?

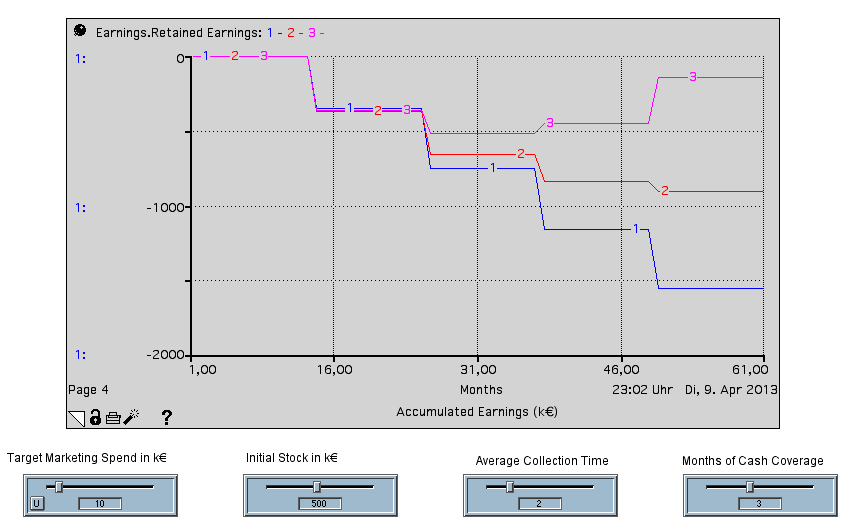

A quick look at the earnings retained over the years shows that this clearly is not enough – we do not just want to be profitable, we want to reach break-even – within five years at least, better within three years.

A little further experimentation shows that we need to spend at least €11,000 per month to reach break-even within 5 years.

Can we grow even faster?

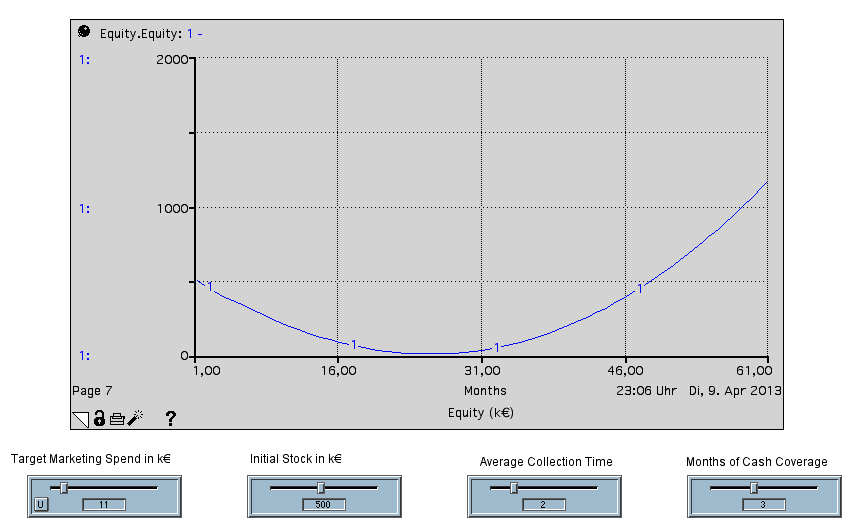

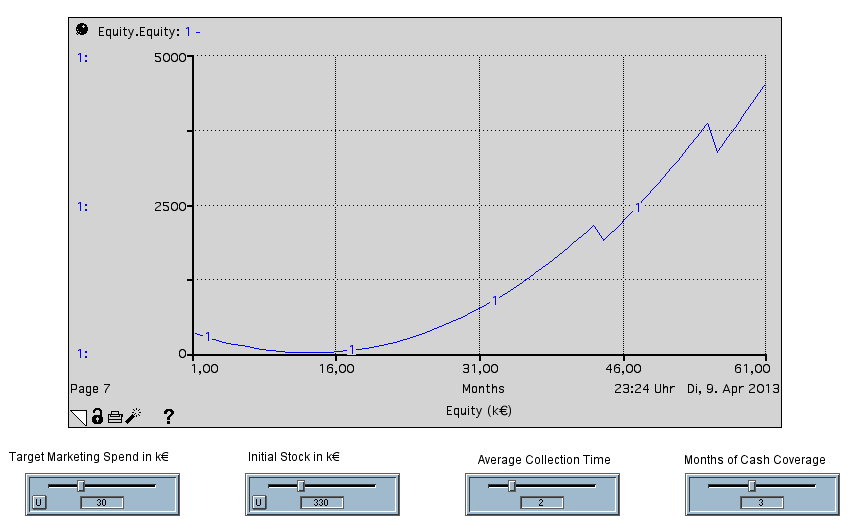

Before we answer this, let us take a look at how we financed our marketing: we started with initial equity of EUR 500,000 (equal to the initial shareholder’s stock). This dips down to EUR 7,000, before rising again to reach EUR 1,15 million after five years.

But if you take a look at the graph showing how we have accumulated debt over the years we see that the amount of debt we have is quite high, peaking at around €440,000.

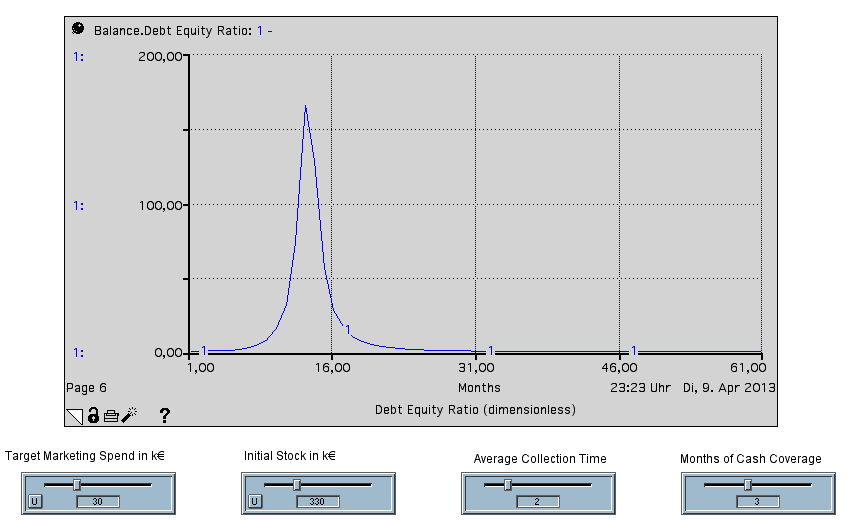

Are our debts too high?

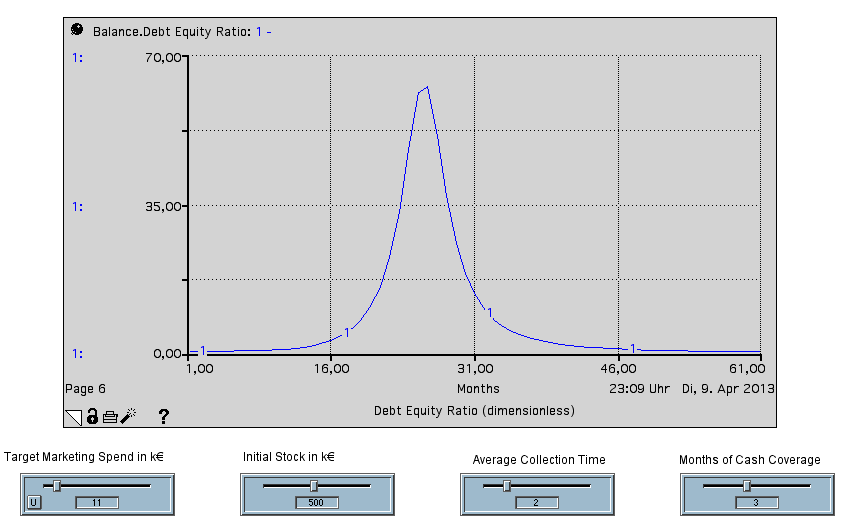

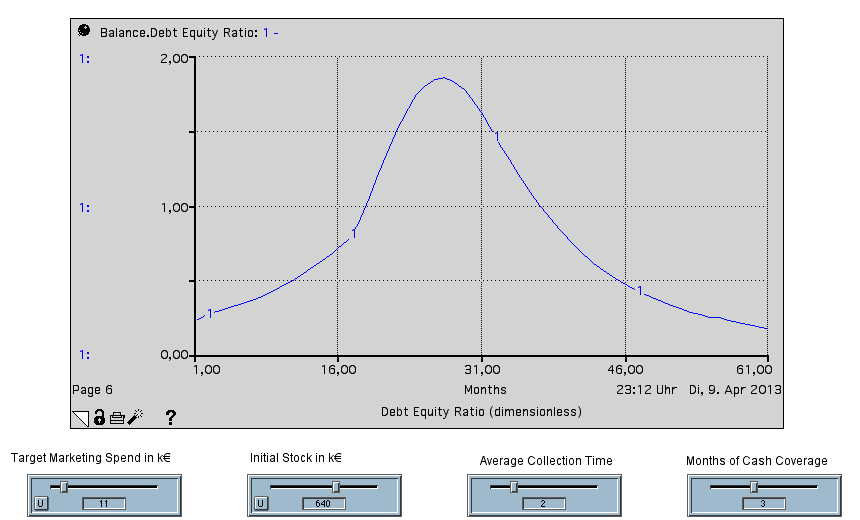

Well, the right KPI to check here is the debt-equity ratio. The graph below shows that if we spend EUR 15,000 per month on marketing, then our debt/equity ratio will reach a peak of around 63 at month 26. This means that our startup company will have 63 times as much debt as it has equity. This clearly is not realistic and there is no way a startup will find debt financing for such large amounts. A good rule of thumb is that the debt/equity ratio should not be larger than 2.

Okay – but how can we achieve this?

Well, we could increase the initial shareholder stock by about €140,000 – our debt-equity ratio then stays below two throughout the simulation.

Interestingly, there is also the option of spending more money on marketing – if we spend EUR 30,000 on marketing per month our debt/equity ratio goes down to 2 and we reach break-even within three years!

This may seem counterintuitive at first – but it is simply due to the fact that spending more money on marketing builds the customer base and thus the revenue stream faster, leading to better results.

Our little experiment with the initial shareholder stock immediately raises the question: how much initial capital do we really need?

How Much Initial Capital do we Need?

Our initial assumption was that we had initial shareholder stock of €500,000. Clearly more would be nice – e.g. a quick experiment shows that with an initial stock of €590,000 we could keep our debt-equity ratio below 1, which would be really healthy.

But could we do with less? If we check to see how the equity develops, we see that even at its lowest we still have €180,000. Technically, our company will only go bust if equity dips below 0. So we should be able to reduce the initial stock to, say €330,000. A quick run of the model shows that this is ok, at least from the equity perspective.

But unfortunately, our debt/equity ratio then jumps to more than 160, which is simply not feasible.

So it seems that €500,000 is quite a good figure for the capital our startup needs to raise initially.

Do we Need Debt Financing?

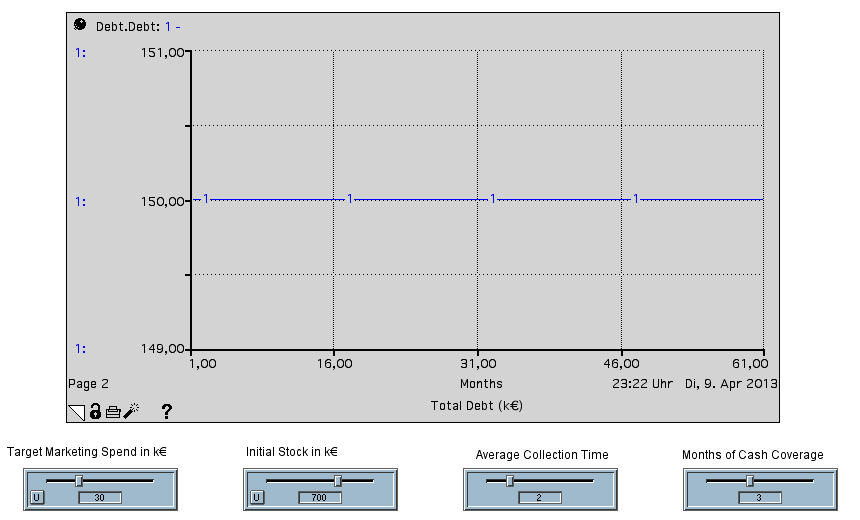

Our discussion above shows we will need total debt financing of around €360,000 if we start with an initial stock of €500,000 and initial debts of €150,000. A little experimentation with the model shows that if we increase our initial stock to €700,000 we can avoid increasing our debt altogether. The initial debt was used to buy the infrastructure needed for service delivery – we could also finance this from the initial stock and do away with debt altogether if we increased our stock to €850,000.

Summary And Outlook

Today we took some time to introduce a small internet startup, to make some basic assumptions about its business model and to perform some experiments using the generic business model prototype.

Even though the model is still quite simple, we have learned quite a lot from it already. Now we are ready to take a look at the prototype in more detail and flesh out the business case.

In my next posts in Prototyping Business Models And Market Strategies, I will give an overview of the generic business model prototypes' internal structure and add some new experiments regarding the internet startup case study.

Workshops

Resources

All Rights Reserved.