The Energy Market Model

A system dynamics model of the energy market

Henning Schneider

Thursday, February 9, 2017

An introduction of a system dynamics model of the energy market

The energy market in Germany is in the midst of a transformation process. This began with the liberalization of the energy market in 1998 and was intensified by the energy turnaround, especially after the reactor catastrophe in Fukushima in 2011. Since 2011, the change process has been characterized by increasing competition and falling electricity prices. Three sustainable trends will determine this transformation process in the future:

- The transformation from centralized conventional to renewable power generation (energy turnaround) Politically, the long-term direction of the energy market is set by the definition of the energy market 2.0, the decided nuclear phase-out by 2022 and the gradual replacement of conventional energy sources by renewable ones (e.g. the energy target 2050: 100% electricity from renewable sources). The associated effects on established business models of energy utilities are manifold and existential.

- Ensuring the balance between supply and demand in the future In the past, supply followed demand. In 1990, large power plants served over 92% of electricity demand, making it easier to balance supply and demand compared to today. Today, not only does demand fluctuate over the course of the day, but so does supply. To an ever greater extent, this is dependent on the prevailing weather conditions (sun and wind) and is, therefore, more difficult to forecast. Flexibility is needed to balance supply and demand, and this flexibility must be available on demand.

- Digitization New technologies, especially communication technologies (e.g., smart grid) are changing the energy market and impacting business models and the behavior of players in the market. In addition, new competitors from outside the industry are entering the energy market and further increasing the intensity of competition. New challenges, such as the issue of IT security, must be addressed and answers found.

The challenge in the coming years will be to master the transition process from the old to the new energy world. Traditional business models based on the production and sale of energy will have to be critically reviewed. New business models focused on the provision of energy-related services, networking and energy management must be developed and driven forward in all areas of the company. In the following Mastering The Complexity of Energy Markets , I will outline how to develop these new business models in the energy market in a structured and targeted manner and thus achieve sustainable economic success.

For this purpose, I will use our business prototyping methodology to place the strategic orientation towards new business models on a solid model-based foundation (more on the methodologyPrototyping Business Models And Market Strategies).

For this blog post, I distinguish the following steps:

- Understand interdependencies in the energy market (this blog post)

- Analyze the behavior of the energy market

- Use the insights gained to develop business models

The Energy Market Model

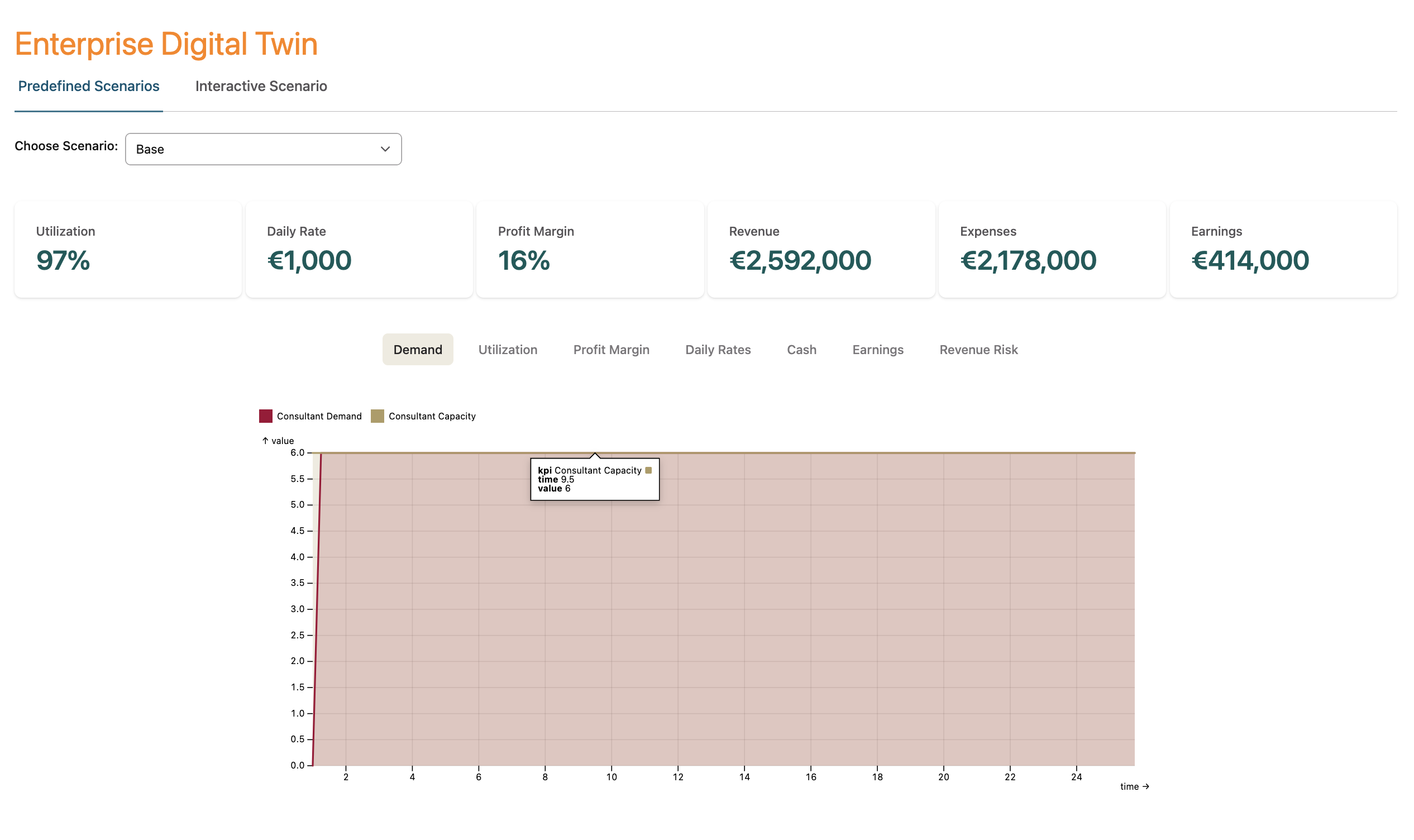

In this chapter, I will build up the energy market model step by step and identify the crucial market players and drivers. The starting point is the following energy market model, which consists of five elements:

The individual elements of the energy market model are related to each other (illustrated by the arrows). Such diagrams are called causal loop diagrams; they are ideal for sketching complex interrelationships.

The model can be divided into two parts:

- The demand side of the energy market is shown on the left. In the simplified model, demand is represented by the elements "demand for energy" and "energy price". The relationship of these two elements can be explained as follows: Rising prices lead to falling demand (e.g., through substitution or abandonment). This relationship is represented by the minus sign on the arrow. Thus, this relationship is the opposite. The relationship between demand and price is a strengthening dependency (plus sign). If demand decreases, the price tends to decrease as well.

- The supply side of the energy market is defined by the elements "energy price", "achievable margin", "incentive to invest in new capacity" and "market capacity". Rising prices lead to rising margins for generators (+). Rising margins lead to a rising incentive to invest in new capacity on the market (+). Higher incentives to invest in new capacity lead to the build-up of new market capacity after some time (+). New capacities or higher supply lead to falling prices if demand remains unchanged (-).

Both the supply and the demand sides of the energy market model are balanced via the price (balancing loop). This is symbolized by the minus sign within the circles.

In the following, I will gradually add the trends described above to this basic model and thereby elaborate on the special features of the energy market and the change process mentioned above.

How Are Renewable Energies Changing The Energy Market?

On the energy market, there are not only conventional/fossil energy sources (e.g. coal, gas) for power generation but also increasingly regenerative sources (e.g. wind, sun). In the energy market model, this means another control loop. As in the basic model, this is defined by the margin, the incentive to invest in capacity and the actual regenerative capacity (supply).

Achievable margins are a key driver for investment in the energy market. Only if margins are positive will new capacity be built, or only if the plant operator can achieve positive margins with electricity production will he use the corresponding generation technology to produce electricity (cf. merit order). Otherwise, electricity production would "burn" money. Margins can be easily calculated by sales minus costs. However, costs depend very much on the generation technology. Costs can be divided into operational costs and investment costs. Renewable energy has negligible operational costs (e.g. maintenance) while the operational costs for conventional energy are determined by fuel and certificate costs for CO2.

In contrast, investment costs for renewables are significantly higher (lower electricity production or full load hours) than for conventional energy.

What Influences The Margins of Renewable Energies?

The achievable margins for renewable energies differ from the margins of conventional electricity producers for yet another reason. Since there is a political will to convert power generation to renewable energy sources in the long term (energy turnaround), these are subsidized by the state. Without this support, plant operators would hardly be able to achieve positive margins (external effects of conventional generation are not considered). Negative margins mean a decreasing incentive to invest in capacities and would slow down or even prevent the expansion of renewable capacities. The margin for renewable energies must therefore be expanded in the causal loop diagram to include government subsidies.

As described, state support starts with the margin for renewable energy. The element "State support for renewable energies" is closely linked to the elements "Share of renewable energy" and "State target for the share of renewable energy". This target is defined, for example, by the 2050 energy target mentioned above. By increasing or decreasing state subsidies, the state tries to close the gap between the actual share and the target for the share of renewable energy.

The energy market model presented forms the basis for the following analyses. I hope to have aroused your interest in the energy market and that I have been able to introduce you to the methodology of causal loop diagrams for analyzing complex interrelationships.

Summary of findings from the energy market model:

- What the core elements that make up the energy market are

- What the relationship between these elements is

- Achievable margins are important drivers on the energy market and define the energy supply in the medium term

- The process of change on the energy market is desired by the state and serves the goal of reducing dependency on fossil energy sources

Services

Workshops

Resources

All Rights Reserved.